TransferWise is one of the leading online services for sending and receiving money abroad. The main advantage of the service is that TransferWise's exchange rate is based on the standard, mid-market rate and they don't add a margin on top of that rate. Today, TransferWise offers money transfer from 59 + countries and receive money in 160 + currencies. Most transactions are processed within 5 minutes.

Xoom is a subsidiary of the world famous PayPAl, which also allows you money transfer from a bank account, card or PayPal balance. In most cases, transactions are also processed within a few minutes.

The main difference is that Xoom provides the ability to receive transfers not only to a bank account, but also in cash and even delivered to your home (relevant for several destinations, such as the Philippines). Xoom's exchange rate is above the mid-market rate and is not so transparent as TransferWise and, as a rule, much worse.

Both TransferWise and Xoom are great choices for instant transfers, but due to combination of factors TransferWise is cheaper, but if you need money to be paid to the recipient in cash, only Xoom offers this service.

We recommend to use our real-time comparison engine to get the best exchange rate and the lowest fees before you send money abroad

TransferWise VS XOOM - Advantages and Disadvantages

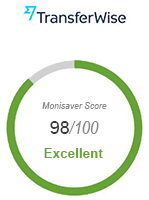

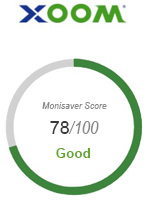

Based on the Monisaver.com rankings, TransferWise wins with 98/100 versus 78/10 for Xoom.

Based on customer preferences and their experience with both companies, TransferWise is clearly the leader. On the Trustpilot website, where users can leave a feedback after using the service, Xoom scored 8.7 points out of 10. However, TransferWise works better - 9.6 points.|

Winner

|

Loser

|

What we like about TransferWise

|

What we like about Xoom

|

What we don't like about TransferWise

|

What we don't like about Xoom

|

Our comparison between TransferWise & Xoom

General features

| Payment methods | Receiving options | Limits | Transfer speeds | Currencies | |

|---|---|---|---|---|---|

|

TransferWise |

Bank transfer, credit card, debit card | Bank transfer |

Min: $1

Max: $199,999

|

5 min - 48 hours |

79+currencies |

|

Xoom |

Bank transfer, credit card, debit card, PayPal account | Bank transfer, cash pickup, home delivery |

Min: $10

Max: $10,000

|

2 min - a few days |

130+ currencies |

TransferWise

TransferWise works as follow: you pay for the transfer from your bank account, debit or credit card and send the money directly to the recipient’s bank account. Options for payment methods vary by country of departure and country of receipt. For example, for transfers from the USA you can pay from your bank account via ACH (Automated Clearing House). For transfers from most European countries – you can make a SOFORT transfer.

TransferWise exchange rates are clearly transparent correspond to average market rates, and commissions are transparent and based on the really mid-market rate without adding a margin!

XOOM

The principle of Xoom: you can pay by bank transfer, with a debit or credit card, or use your balance in your PAYPAL account. The options for receiving a transfer depend on the country to which you send the funds: for almost all directions, the possibility of crediting funds to a bank account is available, in some countries you can receive cash transfers at partner points or replenish the account of a mobile operator. For destinations such as the Philippines and Vietnam, home delivery is possible to the recipient.

Xoom also allows customers to pay utility bills in 9 countries: Colombia, Costa Rica, Dominican Republic, El Salvador, Honduras, Mexico, Guatemala, Nicaragua, Panama and Vietnam.

Which has lower fees - TransferWise VS XOOM

TransferWise

TransferWise charges a percentage fee which depends on the transfer amount. Fee varies and can range from approximately 0.6% to 1% (depending on the combination of currencies). When paying for a transfer directly from a bank account, there are no additional fees, when paying with ACH, an additional fee of 0.15% is charged, and when paying directly from a debit or credit card, an additional fee of 0.3% to 2% is charged.

XOOM

Xoom fee depends on the method of payment and receipt of the transfer. Fees are not charged when sending a transfer directly from a bank account, but applies when paying directly from a bank card. For example, when sending a transfer from the USA to the UK in the amount of $ 1000:

• Commission when paying from a bank account: $ 0

• Commission for payment by card: $ 30.49

![]() It is difficult to say which service offers the best conditions in terms of commissions and fees, since TranSerWise always uses commissions regardless of the payment method, and Xoom does not charge commissions for transfers paid from a bank account. Therefore, it is worth paying attention to the following factor, namely, exchange rates.

It is difficult to say which service offers the best conditions in terms of commissions and fees, since TranSerWise always uses commissions regardless of the payment method, and Xoom does not charge commissions for transfers paid from a bank account. Therefore, it is worth paying attention to the following factor, namely, exchange rates.

Which offers better exchange rates?

The exchange rate is one of the most important parameters that should be considered when choosing a company for sending money abroad. After all, it will depend on the courses how much will ultimately be credited to the recipient's account.

TransferWise

TransferWise is one of the few money transfer providers that offers customers real mid-market exchange rates. The company does not add margin to market rates, as the vast majority of competitors do.

XOOM

Xoom, on the contrary, makes money by adding a margin on top of the mid-market exchange rates. Margin size depends on the amount of transfer and currency pairs and, as a rule, ranges from 1 to 3%.

Sending $ 1000 to the UK by bank transfer

| TransferWise | XOOM | |

|---|---|---|

| Transfer fee |

$6.90 |

$0 |

| exchange rates |

1 $= £0.774 |

1 $= £0.767 |

|

Transfer speed |

5 min - 1 day |

Within minutes |

|

Receiver gets (GBP) |

£768.50 | £767.00 |

![]() TransferWise, which offers an average market rate for currency conversion, is the clear winner in this setting.

TransferWise, which offers an average market rate for currency conversion, is the clear winner in this setting.

- TransferWise offers an average market rate without additional margin from above, and the company is a clear leader in this regard

- Xoom does not charge customers fees if you pay by direct bank transfer

- The transfer speed of both companies is very high and for most areas of the transaction processed in a matter of minutes.